Credit card growth strategy & status design

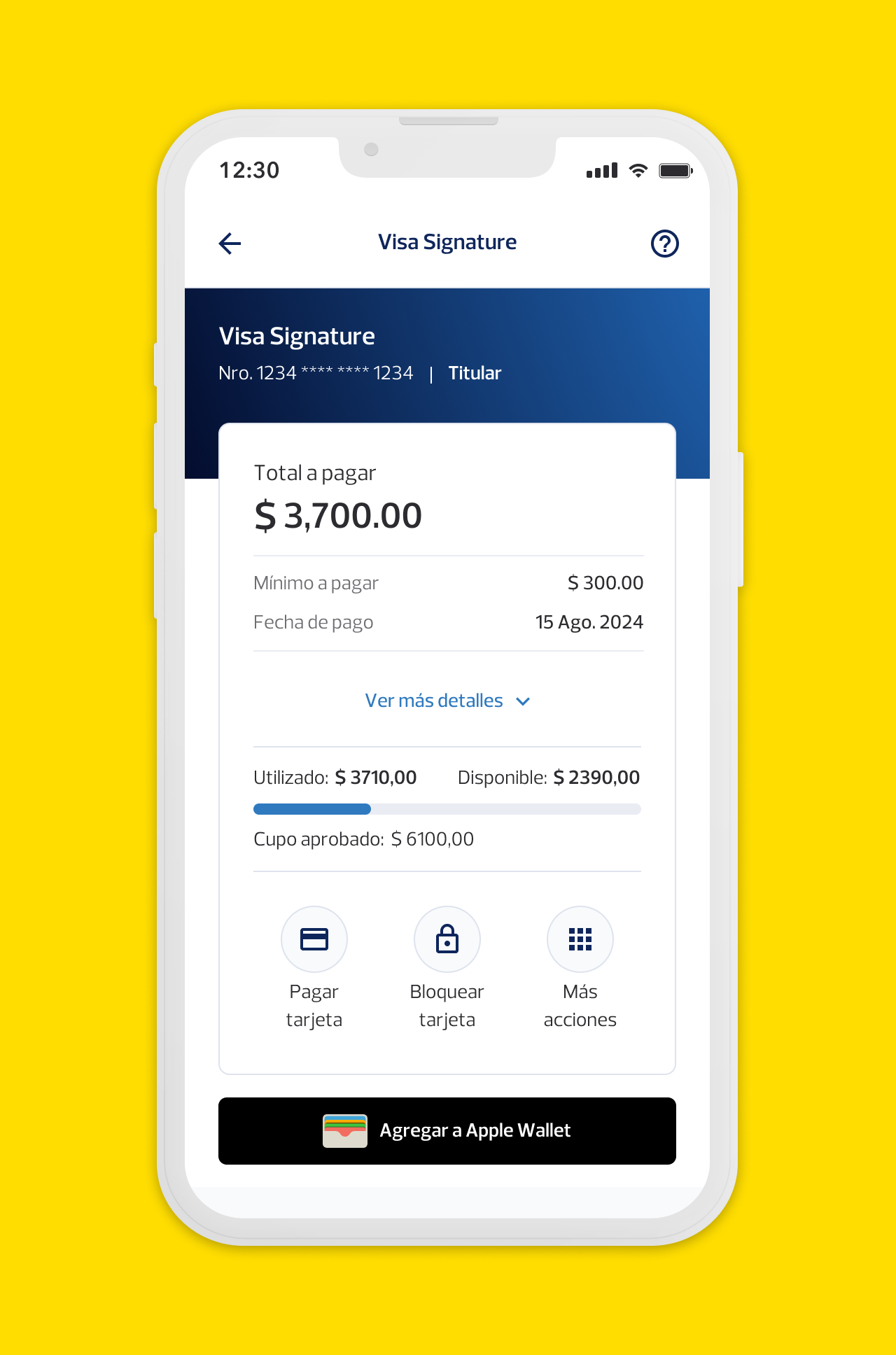

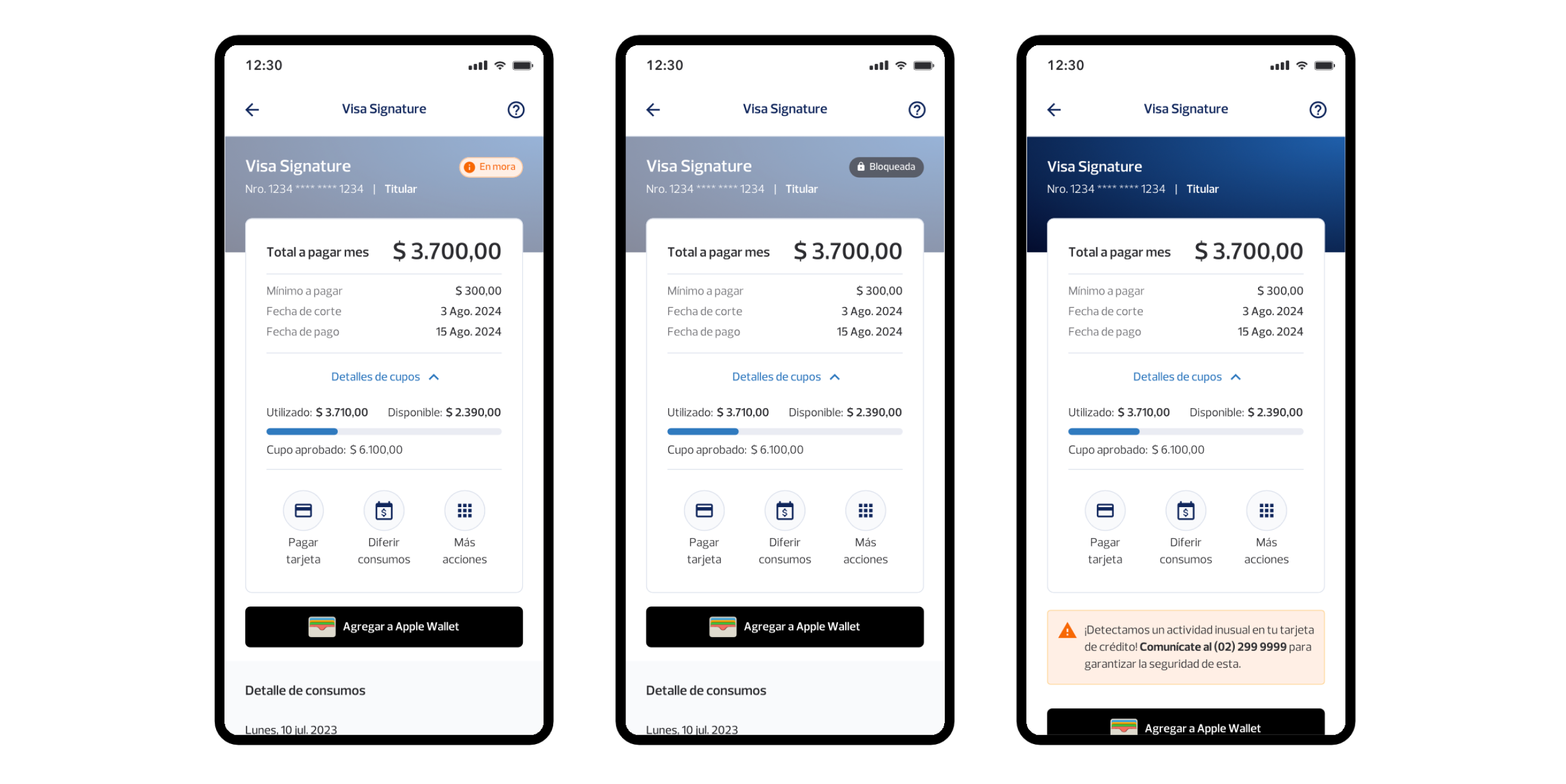

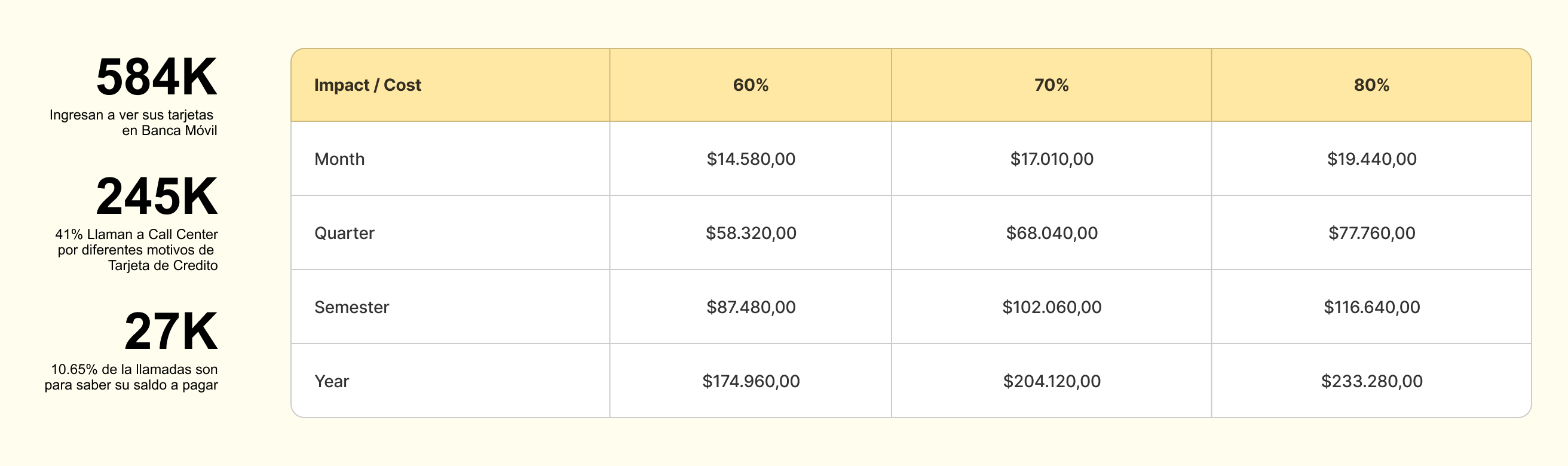

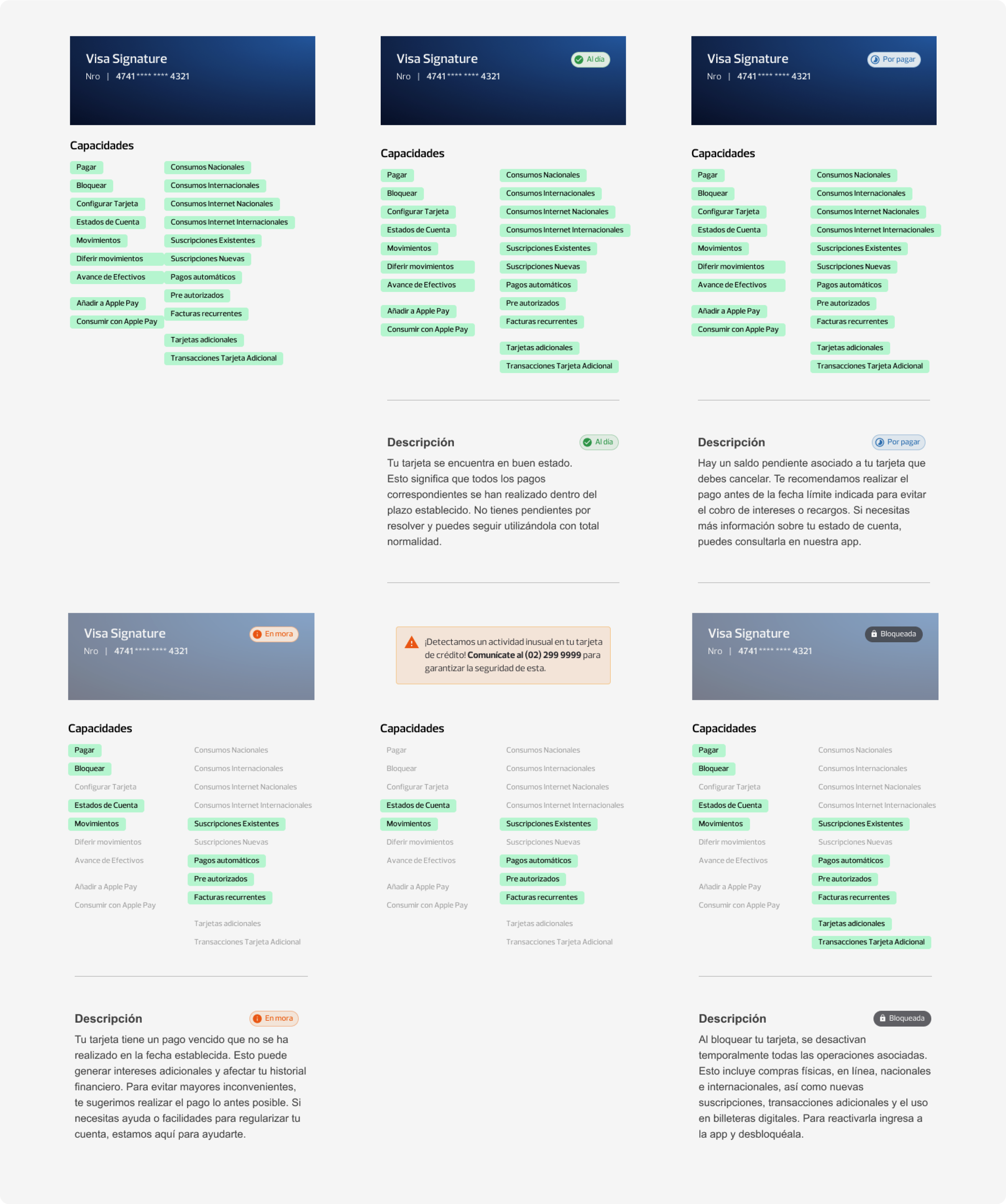

Banco Pichincha, one of Ecuador’s largest banks, is focused on enhancing its customer service model by reducing the 27,000 monthly call center inquiries about credit card payment amounts. This initiative aims to streamline communication, improve customer satisfaction, and optimize operational efficiency.

Task

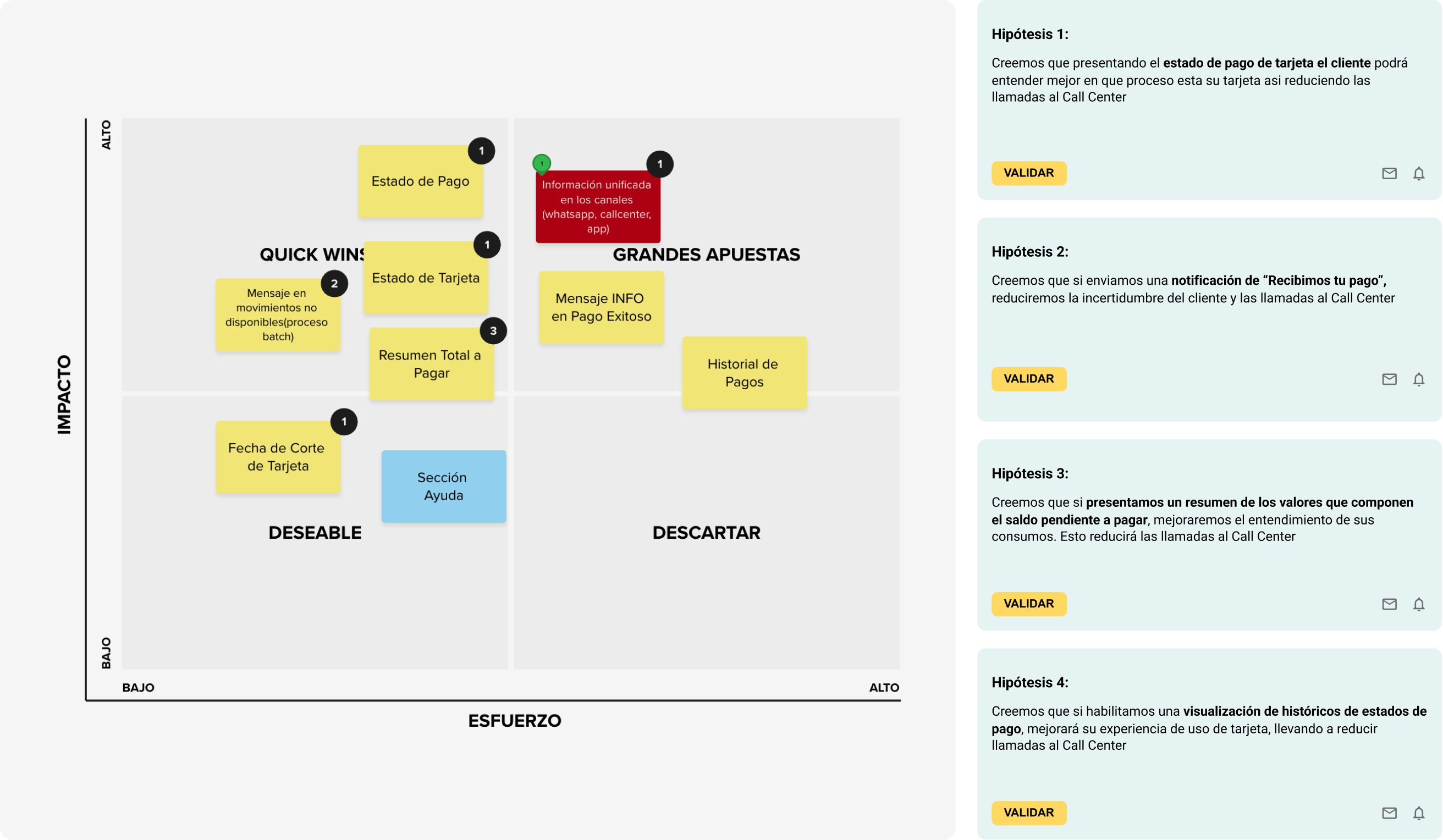

Develop a design strategy and hypothesis roadmap to define and validate the customer value proposition.

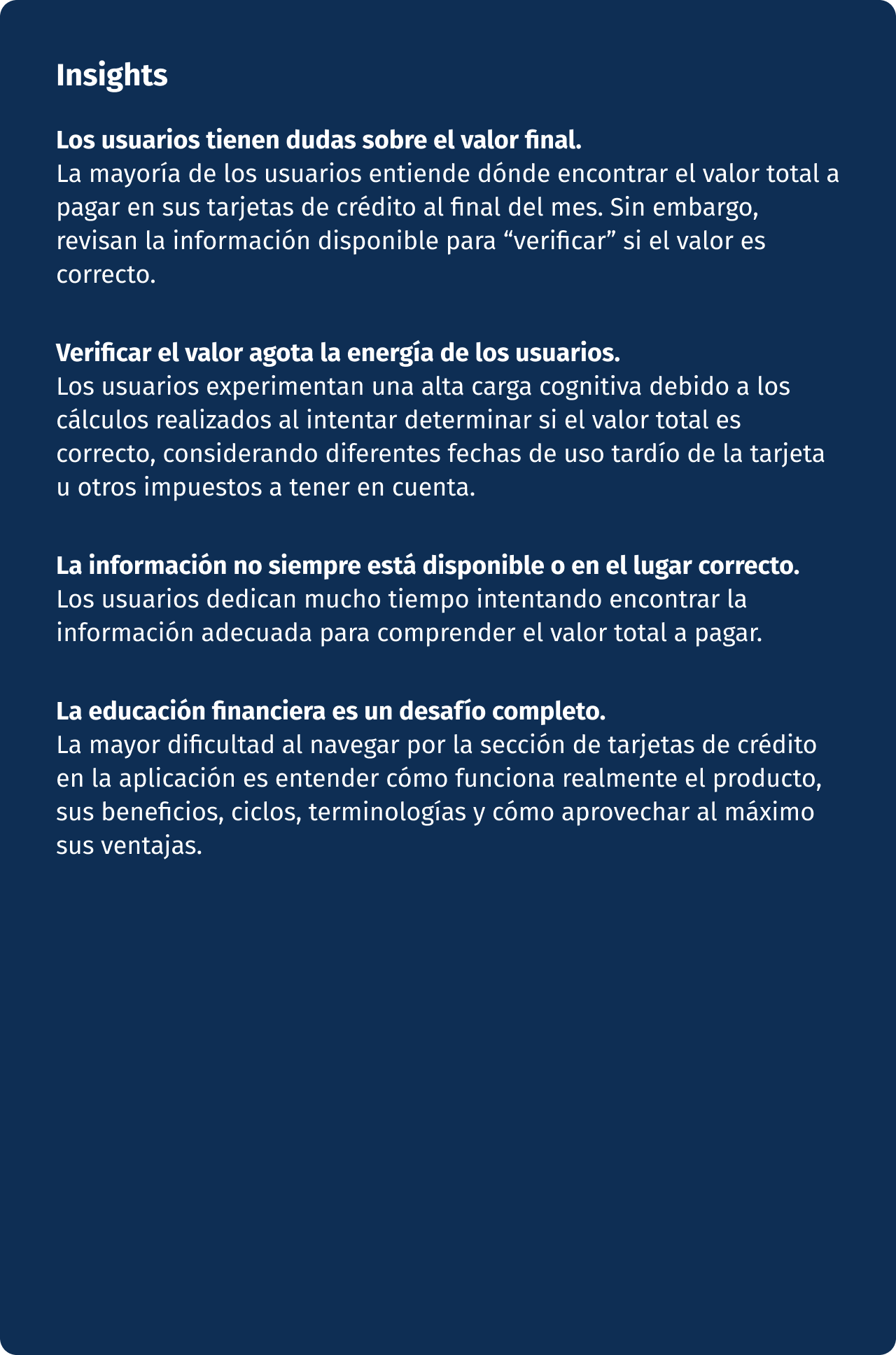

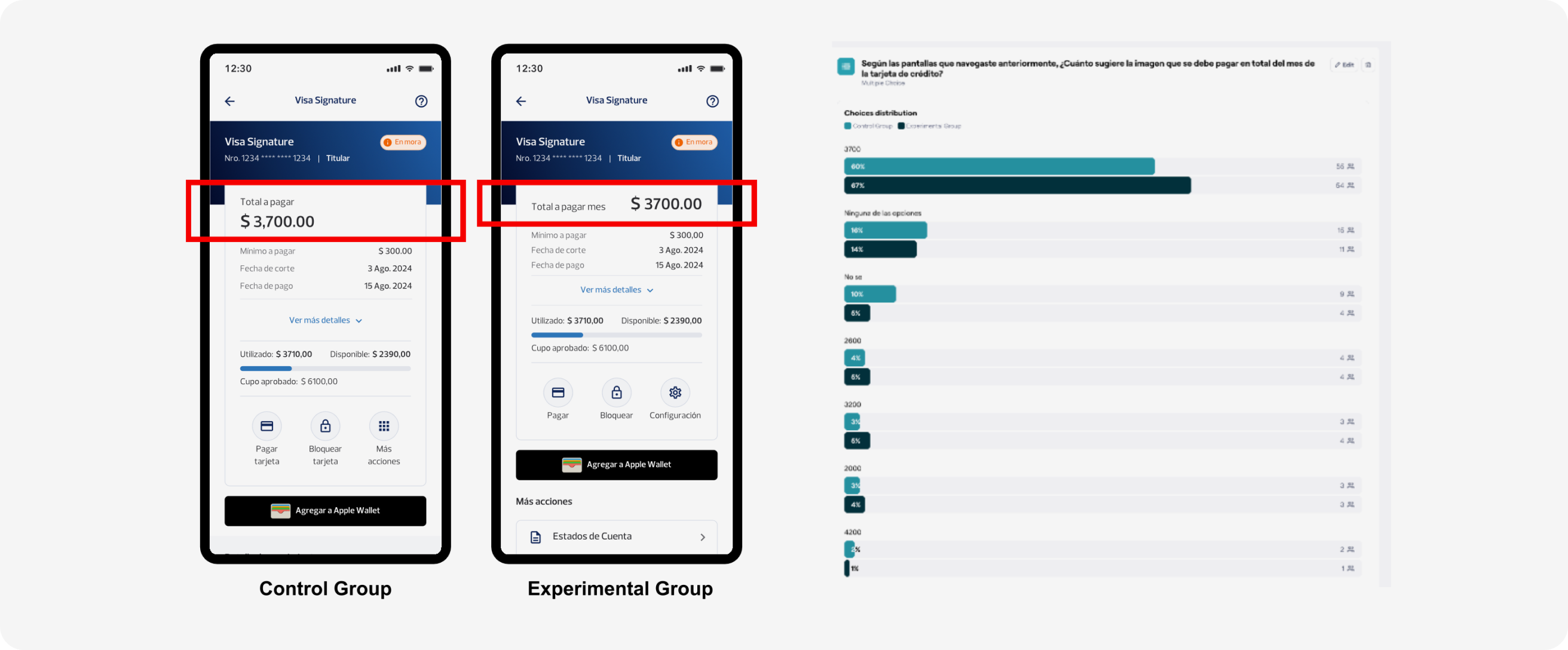

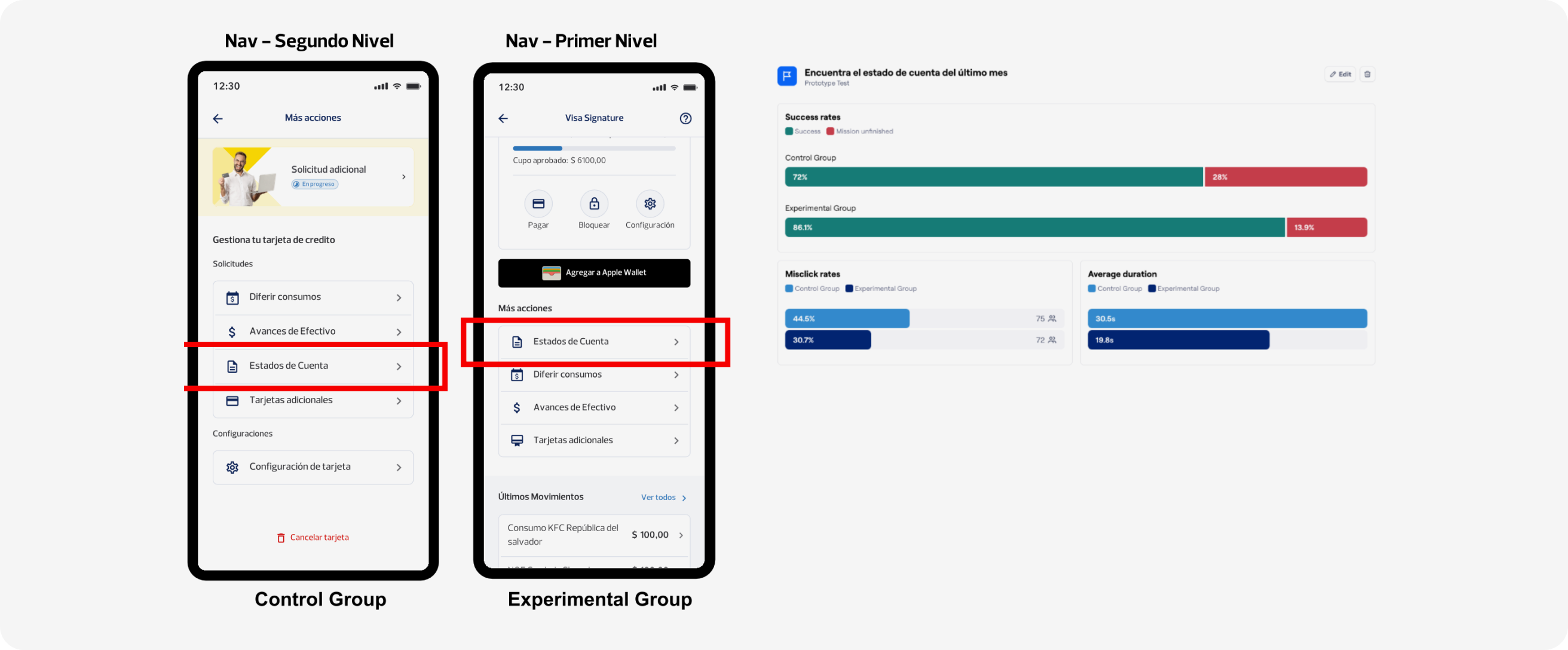

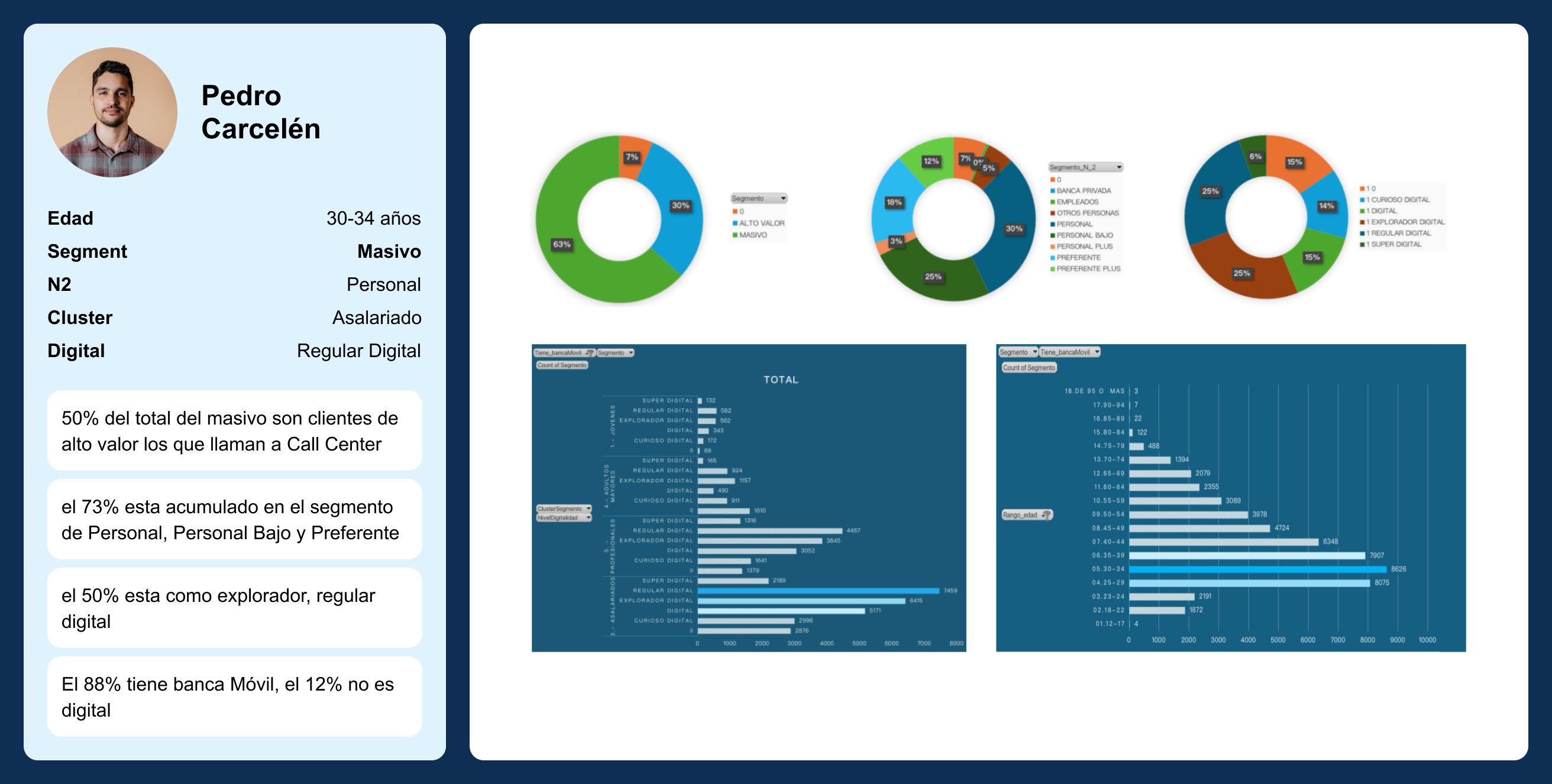

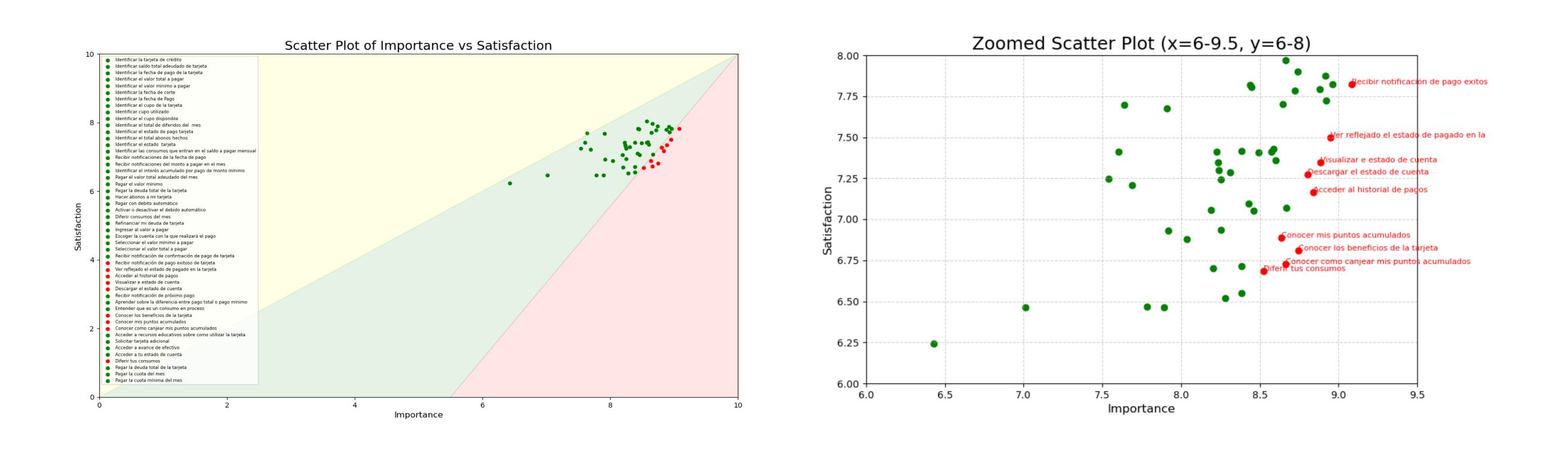

Through strategic research and in-depth data analysis, we’ve uncovered critical opportunities to enhance user experiences and drive business impact. These include improving financial education tied to products, streamlining information architecture for better usability, ensuring seamless access to data for informed decision-making, and refining communication and notifications to deliver timely, relevant, and engaging updates. By addressing these areas, we aim to create solutions that are not only functional but also empowering and user-focused.

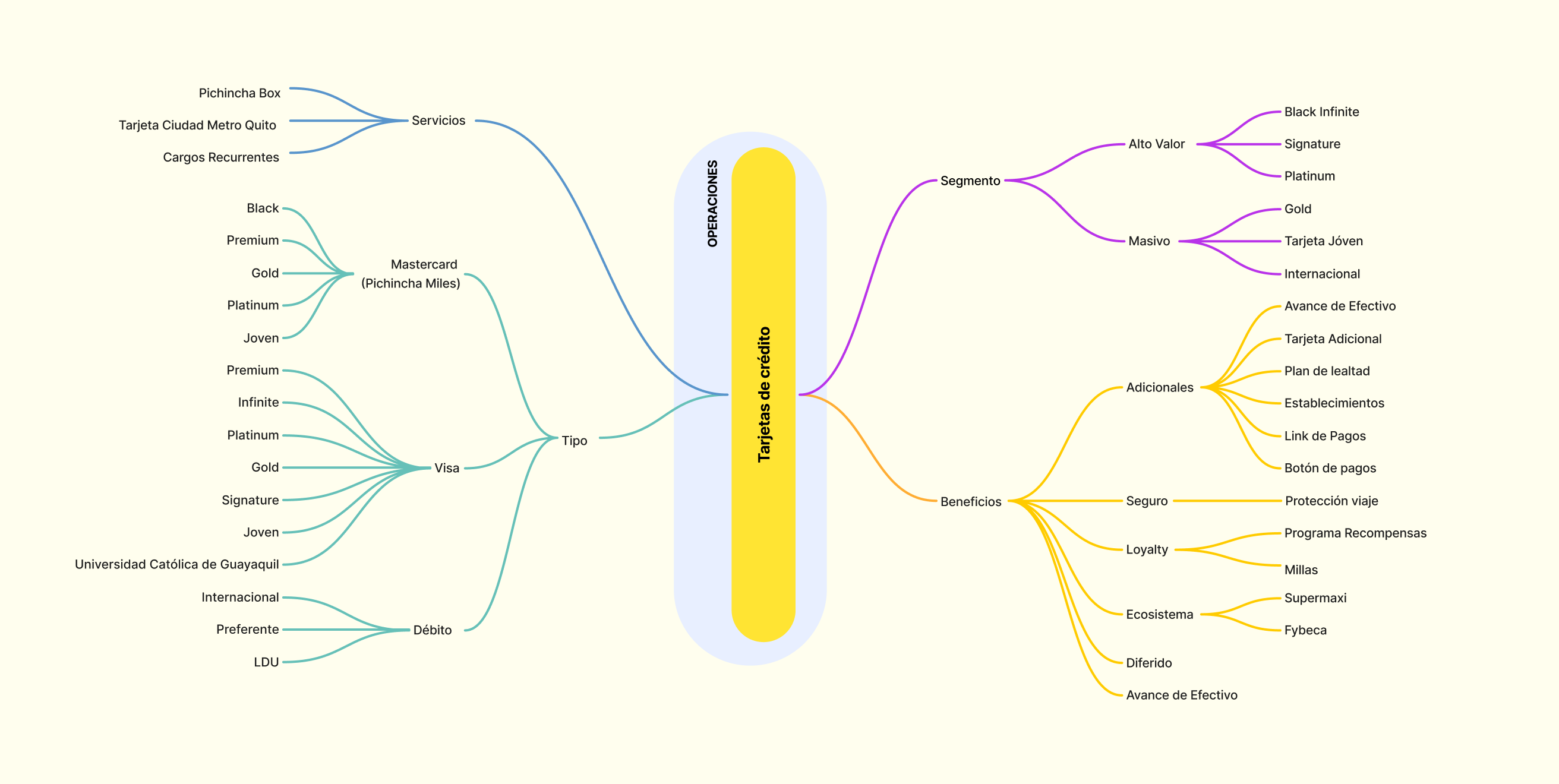

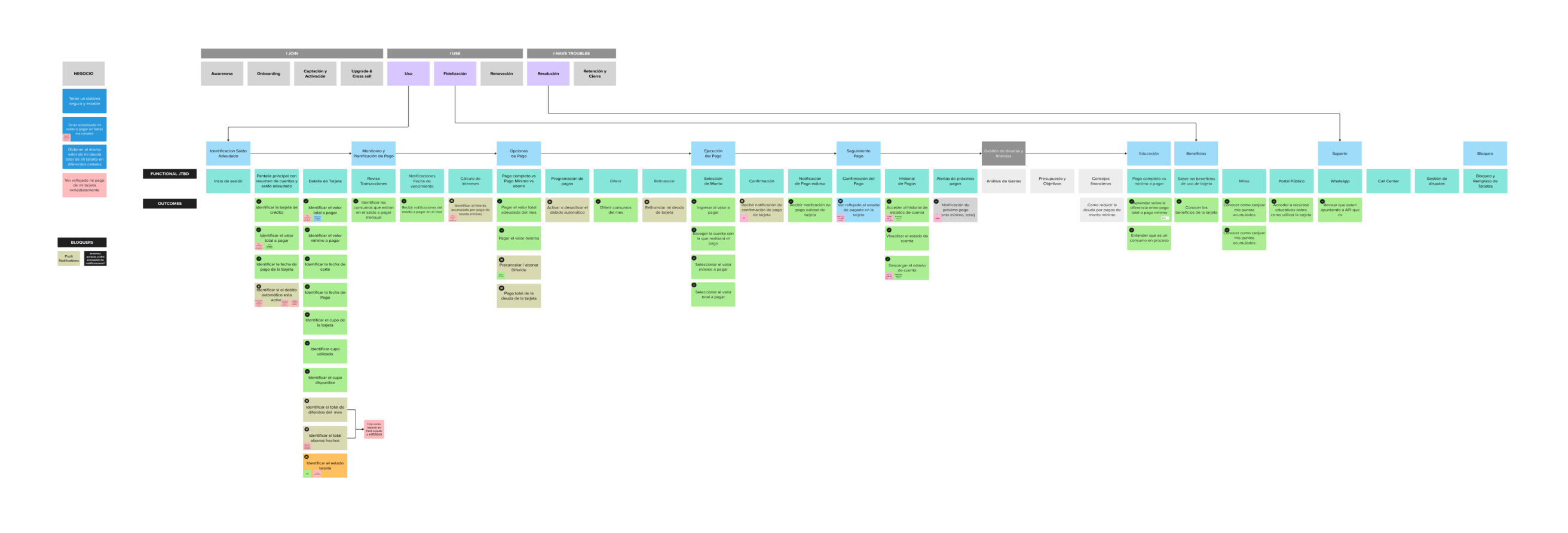

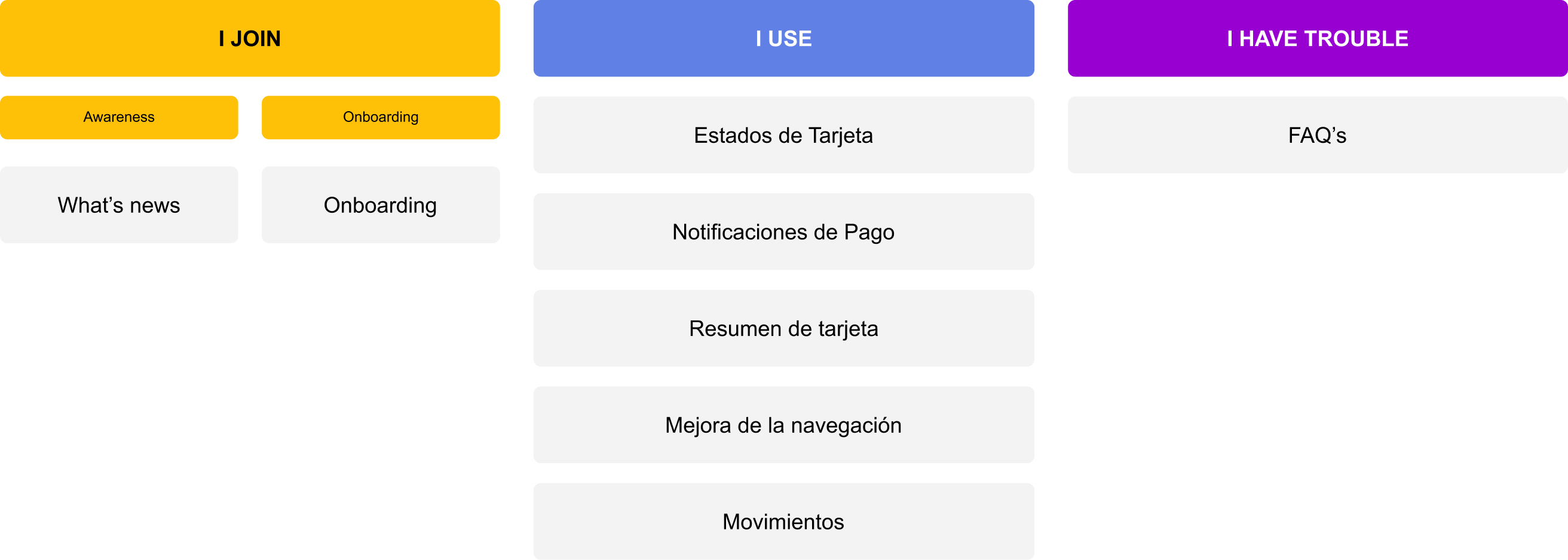

To understand de problem we need to understand first the product and the business behind the product that is using the customer. For that purpose we review the existing benefits that Bank Credit Card offers to their users. A simple map of what is the current offer in their website

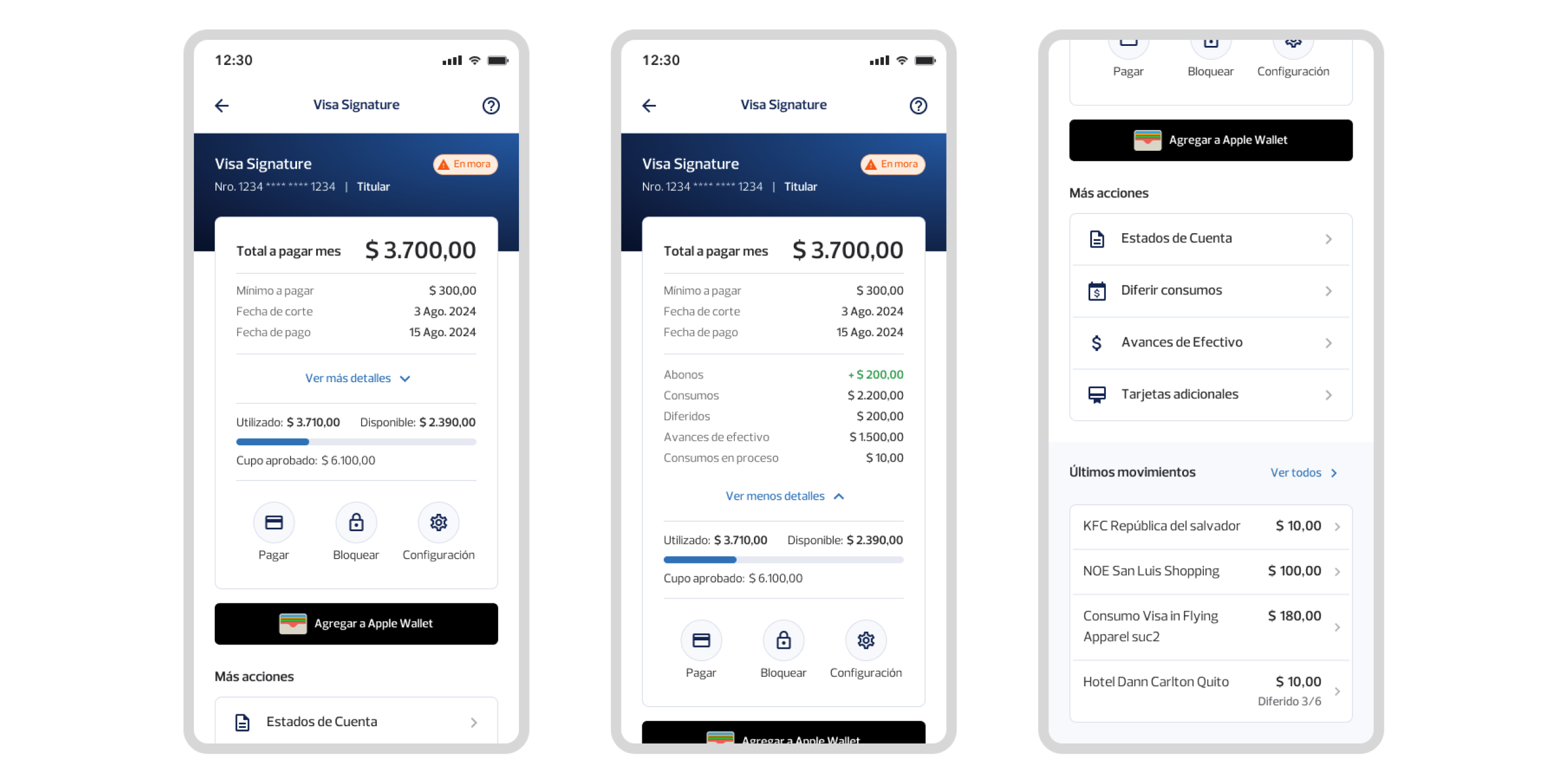

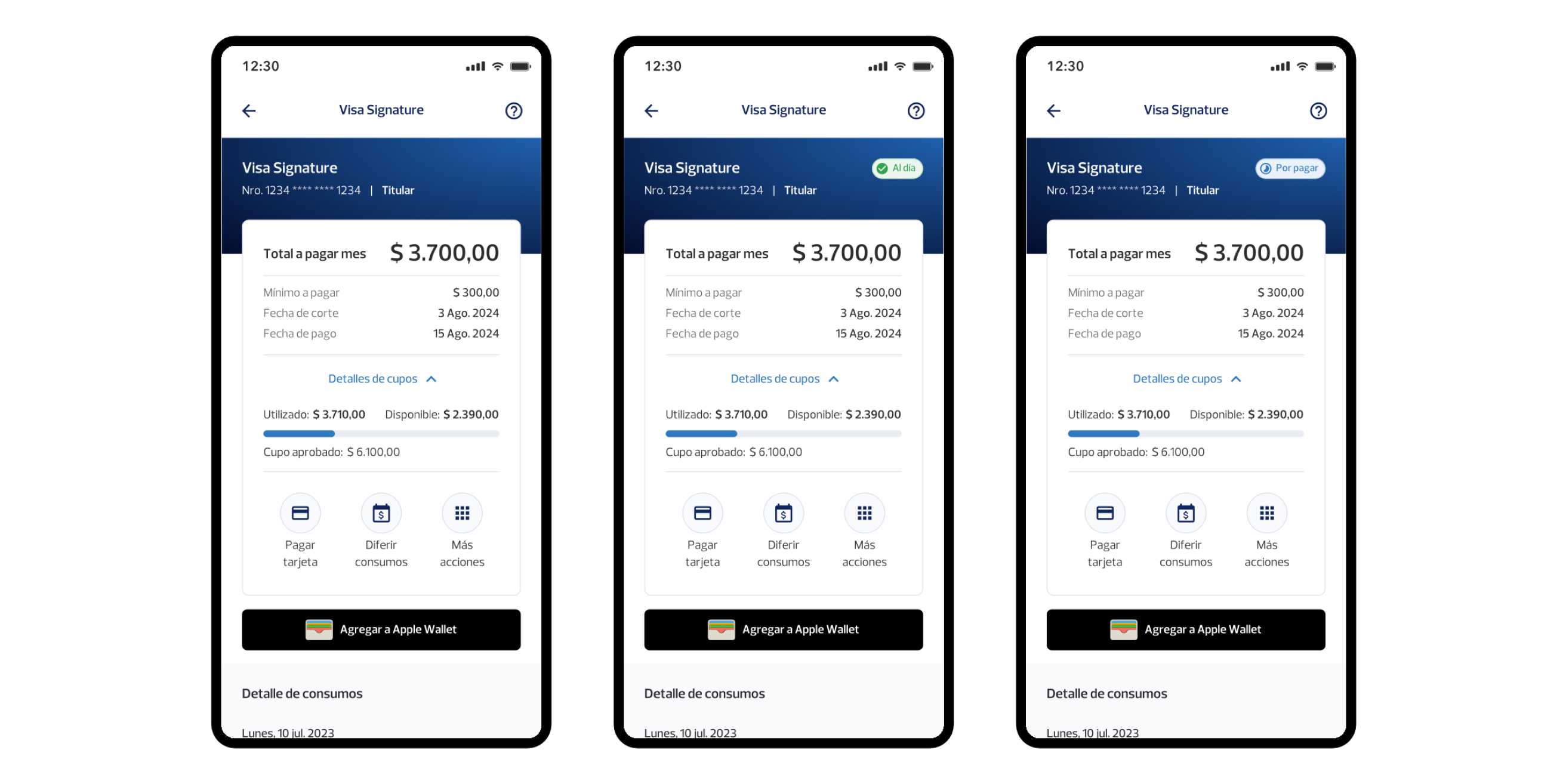

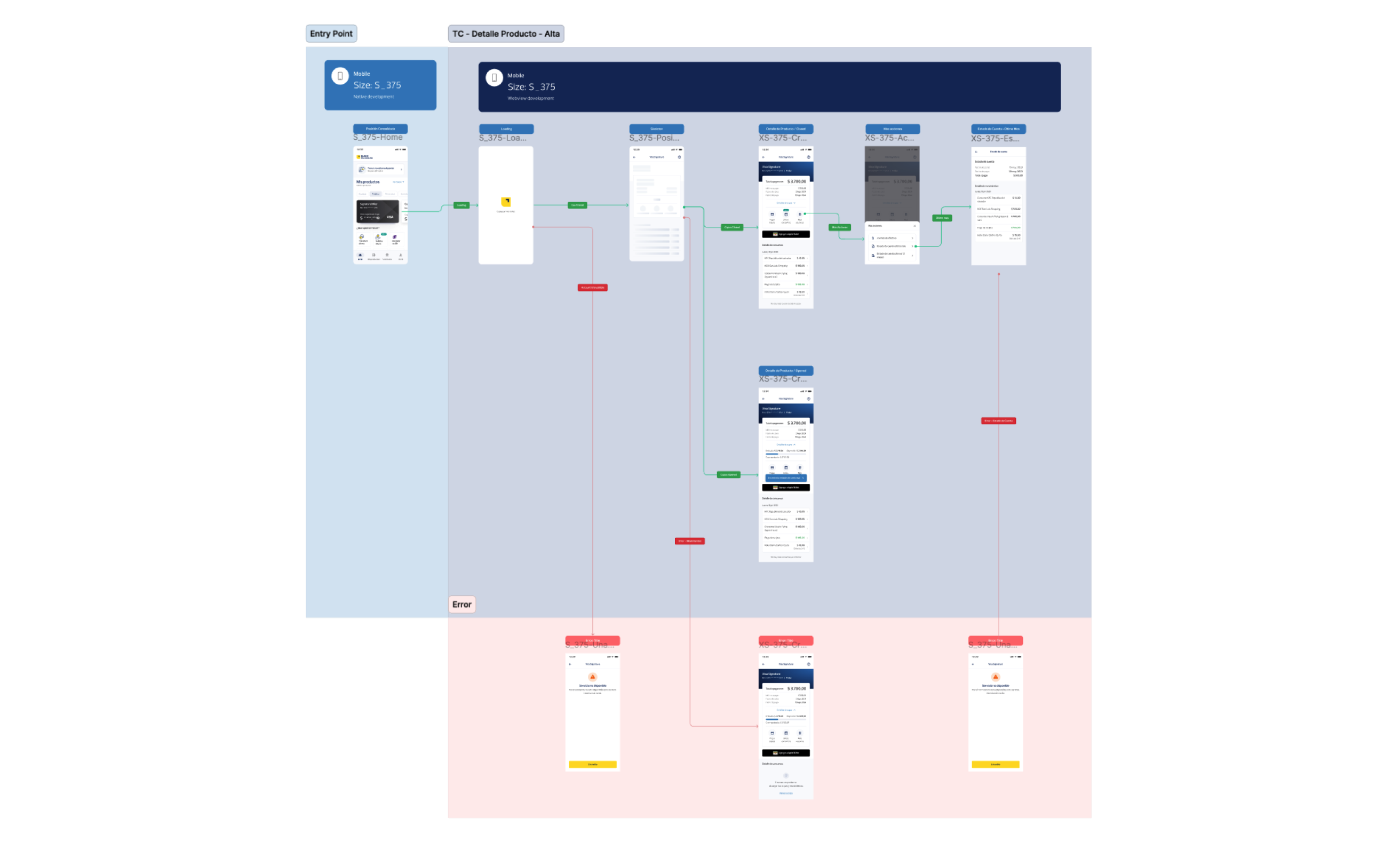

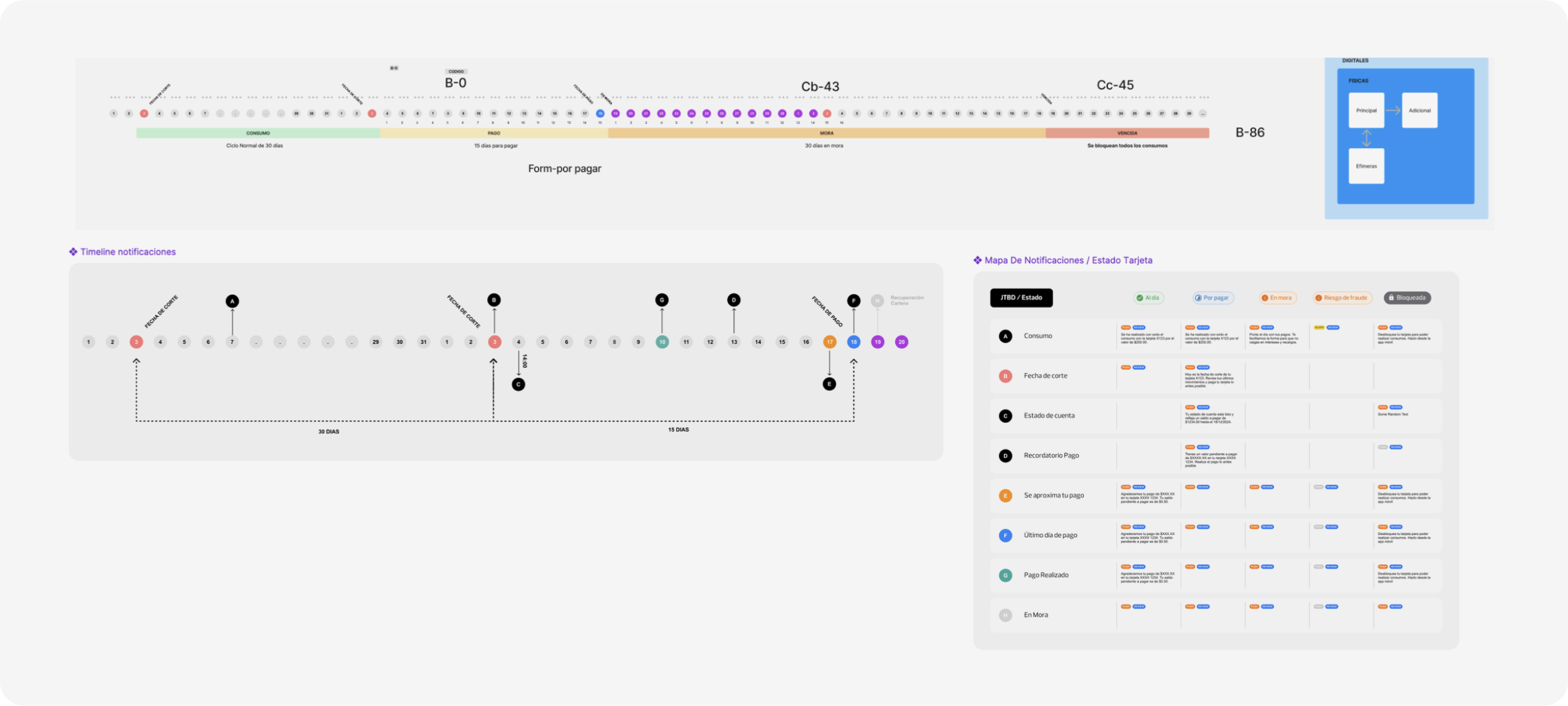

The solution focus on delivering early notifications and keeping information up to date and accessible on all channels. At the same time, progressively educate users on the benefits and terminology of credit cards because this way we can increase customer retention and engagement by reducing overdue and defaulted portfolios and calls to the Support Center.

The direct solution to the user to create user adoption and capacities growth is to enable direct access to standard and organized information

Complete this text

I’m multidisciplinary designer, scientist and technologist who are excited about unique ideas and help companies to create amazing solutions by crafting business, service and product design.